Porter’s Five Forces Model of Competition Analysis

Managers in a firm/company can use various models for analyzing the industry environment. However, the most widely used model for an industry’s competition analysis is Porter’s 5 Forces or Michael Porter’s Five Forces Model. Strategic managers can analyze the competitive environment by using this model in the industry. Porter’s Five Forces Model provides a framework to identify industry-related scopes and threats. We discuss this porter’s 5 forces here in detail.

Michael Porter’s Five Forces Model:

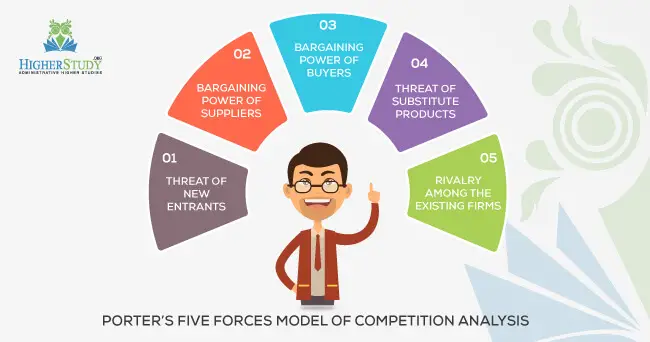

Michael Porter published a book named “How Competitive Forces Shape Strategy” from Harvard Business Review in 1979 (March-April). He developed a framework of the Strategic Management Models that named Porter’s Five Forces Model of Competition. Managers can use it to analyze competitive forces in the industry’s environment. It helps them identify the industry-related scopes and threats face to face their company. A look at Porter’s five forces model that appears in the following infographic would enable you to have a broad view of the model’s elements. You will find that there are porter’s 5 forces or factors that shape competition in an industry. These are:-

- The threat of New Entrants

- Bargaining Power of Suppliers

- Buyer’s Bargaining Power

- Risk of Substitute Products

- Rivalry among the Existing Firms

We provide here a discussion on the impact of Porter’s 5 forces. And the individual force of Porter’s 5 forces in the industry can have on a firm within the industry.

The threats of New Entrants:

The dangers of new entrants are the first one of Porter’s five forces model. It refers to the risk of new entry by potential competitors. In the marketplace, some competitors are already operating their businesses. They are called existing competitors. Some other upcoming competitors are not now running the company in the industry, but they can enter into the industry if they have the capability and desire to enter. They are potential competitors. BTTB once went into a potential competitor in the cellular phone industry. BTTB (BTCL) came into the industry with its cheaper mobile phones, although it could not initially manage the market-situation well.

Porter’s 5 forces of Porter’s five forces model think that Potential competitors generate threats to standing companies. Because if they arrive, they can create race harder by taking away market share from the remaining companies. Thus, present companies fall on potential competitors from inflowing into the industry by making barriers to entry. ‘Barriers to entry’ are created by undertaking some measures that are very costly for the competitors to adopt. Such restrictions may require strong brand loyalty, absolute cost advantage, sizable economies of scale, high capital requirements, difficulties of building a distribution network of distributors and retailers, restrictive tariffs, international trade restrictions, and government regulations.

In contrast, if the threat of access by potential competitors is low-slung, the ruling companies can increase prices and generate higher profits. When entry barriers are low, it is easy for potential competitors to enter the industry. Despite entry barriers, many entrants enter the sector with appealing products. The strategy-creators need to pinpoint the entrants, screen out their tactics and strategies, and take on counter-plan and deal with the getting issues building on the firm’s surviving capabilities and resources.

More read: 6 Steps of Strategic Management

Bargaining Power of Suppliers:

The bargaining power of suppliers is the second of Porter’s five forces model. A business has to make many types of ‘supplies’ from the suppliers, such as items, raw materials, parts, and other resources necessary for manufacturing a product. When the dependency of the customers is high, the bargaining power of suppliers is enhanced. Powerful suppliers can raise the prices of materials. So, influential suppliers are a risk to the businesses who have to purchase at that rate. If suppliers are no stronger, a firm may be in a beneficial situation. It can claim high quality at a minor rate from the suppliers. The amount of suppliers is very few, and they are stable in negotiating prices in the paper industry. It has created a threat to the publishing industry.

Not the less, this threat has been to some range weak due to imported paper. If the materials they sell are available from different parties, Suppliers have very little or no negotiating power. Their power rises if the supply of the materials is limited or if the documents are such that they are inevitable for the company. For instance, Intel Corporation is the most influential in the computer marketplace on account of its unusual situation in manufacturing microprocessor (Pentium).

Read more: Steps of SWOT Analysis in Strategic Management

According to Michael Porter’s Five Forces Model, suppliers are most potent. Such as:-

- When buying, companies cannot use the treat of vertically integrating backward and supplying their own needs to reduce input prices.

- The product that they sell has few substitutes and is vital to the company.

- When to raise prices, they can use the threat of vertically integrating forward into the industry and competing directly with the company.

More read: Competitive Advantage Business Strategy

Porter’s Five Forces Model says that suppliers’ bargaining power is weaker under the following circumstances in the industry. Such as:-

- The customers can buy the same products from many suppliers at the same prices.

- Substitute products acceptable to the buyers are readily available.

- It is essential for the suppliers when continued large purchases on the part of the customers.

- The vast quality of products is available in the market.

- Thus can have a win-win gain when the customers have ample scopes to develop the strategic alliance with other suppliers.

- When buyer-firms can integrate back into the supplier’s business and thus can satisfy the customer’s requirements.

More read: Models of Participatory Governance

Bargaining Power of Buyers:

The bargaining power of buyers is the third one of Porter’s five forces model. Buyers of products may be ultimate consumers or even the mediators such as dealers, wholesalers, and retailers. When suppliers have to depend on them for some reason, the buyer’s bargaining power becomes high. On the other hand, their bargaining power is weak when suppliers or sellers can raise prices. Whether seller-buyer relationships denote a weak or strong competitive power, it depends on the buyer’s bargaining power to influence the rules and regulations of the sale in their deserved and the range of buyer-seller strategic partnership in the industry.

According to Michael Porter’s Five Forces Model, the buyer’s bargaining power is highest. Such as:-

- Buyers purchase in essential qualities.

- Through vertical integration as a device for forcing down prices, buyers can use the threat to supply their own needs.

- The supply industry is composed of many small companies, and the buyers are few in number and plentiful.

- The supply industry depends on the buyers for a large percentage of its total orders.

- It is economically feasible for the buyers to purchase the input from several companies at once.

- Buyers can switch orders between supply companies at a low cost.

According to Michael Porter’s Five Forces Model, a Buyer’s bargaining power is generally weaker. Such as:-

- When the cost of procuring products from alternative sources is very high.

- The buyer depends on the seller because the brand reputation of the seller is critical to the buyer.

- The buyer purchases a particular product from the seller in a small quality or does not purchase frequently.

- When there is a high demand for the seller’s products in the market and as a result, a ‘sellers’ market prevails in the industry.

More read: Steps of POSDCORB with Examples

The Threat of Substitute Products:

It is the fourth factor of Porter’s five forces model of competition analysis. A company needs to consider the competitive pressures from substitute products. The substitute products may originate from either the same business firm or from another business firm. For instance, cotton producers are in direct competition with the producers of polyester fabrics. Newspapers compete against television in providing the latest news. E-mail is a substitute for the overnight delivery of documents by courier service companies. Coffee is a substitute for tea. Bottled water is a substitute for juices and soft drinks. Plastic bottles are substitutes for aluminum cans for beverages. Traditional film cameras are fighting hard against their substitute-enemy – the digital cameras.

If the buyers view the substitute products as ‘good substitutes.’ Competitive pressure automatically emerges from the actions of the companies producing substitute products. For example, Lasik’s cooperation of eyes has created intense competitive pressure on the producers of eye-glasses and contact lenses. Similar is the situation between VCRs/videotapes and DVE players, and between landline telephones and mobile phones.

Read more: What is SWOT Analysis?

Following the fourth factor of Porter’s five forces model, the significant factors that determine the strength of the competition from substitutes are:-

- The attractiveness of the prices of substitutes

- Buyers satisfaction with the alternatives in terms of quality and other features

- The easiness to switch to substitutes.

When the substitutes are available at lower prices, the natural product producers are under highly competitive pressure to reduce rates. When alternative products are available, the customer begins to compare prices, quality, etc., with regular products. Similarly, when swapping, the natural product’s cost to substitute products is low, and buyers turn more disposed to the substitutes.

Besides Porter’s Five Forces Model, Thompson et al. have indicated three signs that point to stiff competition from substitutes. These are:-

- Sales of alternatives are growing faster than sales of the industry.

- Producers of substitutes are moving to add new capacity.

- Profits of the producers of substitutes are on the rise.

A company’s threat may be the existence of substitute products in the industry. Thus, the profit of the company is likely to reduce due to cutting down prices. If a company has few substitutes, it has the opportunity to raise rates and thereby increase profits.

More read: Forms of Public Enterprise

Rivalry among the Existing Firms:

A vital force in Michael Porter’s Five Forces Model is the extent of contention among the settled firms in the industry. In an environment of weak rivalry, a firm can raise prices and make higher profits. When competition is intense, the sector may face severe price-ware in which firms compete against each other based on price cuts. If there is pure competition among the companies in the industry, cost-effectiveness declines substantially. Arthur A. Thompson and A. J. Strickland III regard this force of rivalry as the ‘strongest of the five forces.’

Michael Porter identified several factors through Porter’s five forces model in competition stems or Inter-company rivalry. And these factors are mentioned in his famous book Competitive Strategy. These are as follows:-

- Competition is usually stronger when demand for the product is growing slowly.

- It increases as the number of competitors increases.

- Competition is stronger when the customer’s costs to switch brands are low.

- When industry conditions encourage competitors to cut prices, competition is more intense.

- When it costs more to get out of a business than to stay in the industry, competition tends to be more intense.

- Competition is stronger when competitors are dissatisfied with their market position and undertake other measures dissatisfied with their market position and undertaker other measures to win the battle for market share.

- Big companies get the incapable companies in the business from outdoor the industry and take off aggressive movements to make the picked up companies money-spinning, competitions increases.

- When competitors are diverse, competition becomes more volatile in their objectives, strategies, resources, etc.

More Read: Value Chain Analysis Model

Porter’s Five Forces Model has a significant fault as a tool for competition analysis. It can use for analyzing only the degree of competition in the industry. As the dominant economic aspects in the industry relevant to managerial strategy-making, it cannot discover such forces. It was also unable to isolate the driving forces – the main reasons for changing industry situations. This model their likely strategic moves and overall industry allure. These faults can overcome by using Thompson and Strickland’s Seven Factors Model of Industry Analysis.

I am sure this paragraph has touched all the internet visitors, its really really nice piece of writing on building up new webpage.

I know this if off topic but I’m looking into starting my own blog and was curious what all is required to get set up? I’m assuming having a blog like yours would cost a pretty penny? I’m not very web savvy so I’m not 100% sure. Any tips or advice would be greatly appreciated.

I really like looking through your post and I think this website got some really useful stuff on it!

Hi to everyone, it’s my first compensation visit to this weblog; this site conveys great and genuinely phenomenal stuff for guests.