What Is Diversification? Levels of Diversification Examples

Corporate strategy is an overall strategy for a diversified company. Since a diversified company has a mix or combination of some businesses in multiple industry environments, the corporate strategy embraces the whole mix of the businesses. It also hugs the ways of integrating and coordinating the strategies of individual business units. Understanding the corporate strategy what is diversification and the three levels of diversification are the most important things. According to Michael Porter who is a pioneer of the 5 Forces Model of Competitive Analysis, corporate strategy concerns itself with four thoughts that companies most ordinarily use:-

- Portfolio Management

- Restructuring

- Transferring Skills, and

- Sharing Activities

Corporate strategy purposes at enlightening the attraction and recital of the diversified company’s overall business. It addresses the entire strategic scope of the company. The procedure of assigning resources among the many strategic business units (SBUs) is the responsibility of the top-level corporate managers. They decide and implement how cash, staffing, equipment, vehicles, finances, and other resources will be distributed among the SBUs. The scope of corporate strategy is much broad – developing cooperative relationships, adding new products or services, issues of diversification, the way of competing with other firms, and the like. At the diversified company, the top-level executives develop a corporate strategy with inputs from the multiple business units.

What Is Diversification?

In general, diversification means spreading out of business either through functioning in various industries instantaneously (product diversification) or starting a new business in the same industry, or inflowing into various geographic marketplaces (geographic market diversification). Diversification happens when a business unit enlarges into a new segment of the existing industry in which the company is already doing business at the business-unit level. Diversification happens when the diversified company arrives into a business outdoor the scope of the standing business units at the corporate-level. Diversification is pursued to upsurge cost-effectiveness through greater sales volume. However, it is not free from risks. And, thus, it needs careful analysis before entering into an unknown market with an unfamiliar product proposing.

EXAMPLE: Numerous companies have practiced disaster with diversification, while numerous others have been significantly successful for example Canon (stimulated from camera-making to making a whole new range of office tackle) and Walt Disney (it moved from making animated movies to theme parks and vacation belongings).

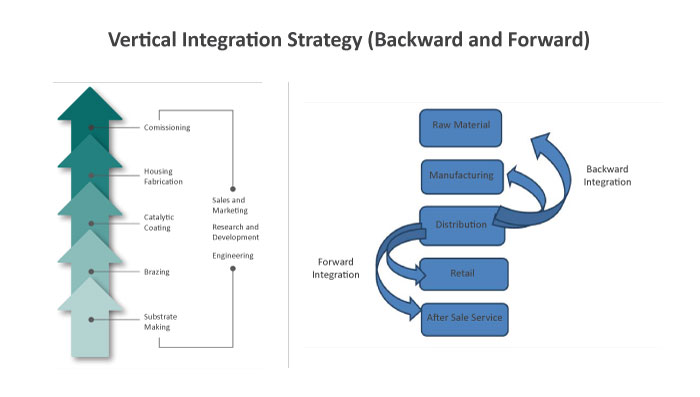

The widespread forms of diversification are horizontal diversification, vertical integration, and geographic diversification. Muhammad Abdul Mannan

Vertical integration involves integrating business along the company’s value chain, either backward or forward. Horizontal diversification contains moving into fresh businesses at the same stage of production as the present operations of the company. Geographic diversification involves moving into new geographic areas. The three forms of diversification may be related or unrelated.

Mini Case Study:

Amily Limited was established at Chittagong in Bangladesh in 1975 as a dairy farm. It operated as a regional organization until 1986. It started with a total capital of Tk. 5 million (Taka is a Bangladeshi currency name), which increased to Tk. 70 million in 2009. Amily Limited has now grown as a diversified producer of a variety of products such as ball pens, toiletries, packed juices, and mosquito coils. When Mr. A. R. Siddiqui was appointed as the CEO of the company, it progressed in the diversification path with continuous success. Mr. Siddiqui had undertaken initiatives to acquire a number of similar types of firms that resulted in the high growth of the company. The CEO replaced the traditional decentralized management with an aggressive strategy of corporate marketing. He attempted to create synergy among the several SBUs through strong coordination among the businesses. The company is now being benefited from the strategies undertaken by corporate management mainly because of the company’s successful exploitation of the potential synergies between the SBUs.

Levels of Diversification:

Approximately management specialists have tried to show that diversified firms differ on the word of their levels of diversification. According to them, three levels of diversification existing:

A. Low Levels of Diversification:

This level of diversification operates its actions primarily on a single or dominant business. The company is in sole business if its revenue is better than 95% of the entire sales. If the produced profits are between 70% and 95%, the company’s business is dominant. 5M Security Services Limited is an example of a firm with little diversification as its primary focus is on the security guards market.

EXAMPLE: Kellog is an example of a dominant business firm because it’s major sales come from ‘breakfast cereals’ and ‘snack foods’. Nevertheless, the companies that create their revenue from sole products cannot be called diversified companies in the right sense of the word.

B. moderate of High Levels of Diversification:

At this level, two types of diversification are evident. Such as –

- Related constrained

- Related linked

Less than 70% of revenue arises from the dominant business and all SBUs/divisions share product, technology, and distribution channels, in the case of related constrained diversification. Less than 70% of revenues come from the dominant business but there are only limited links between and among the SBUs if the firm has related linked diversification.

EXAMPLE: Procter and Gamble is a case in point of the related inhibited firm, while Johnson and Johnson is an example of a related linked firm.

C. Very High Level of Diversification:

This level is applicable to companies that have unrelated diversification. It produces less than 70% of its profits from the dominant business but there are no mutual links between the SBUs.